2018-05-05 07:33:00 Sat ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Warren Buffett shares his fresh economic insights and value investment strategies at the Berkshire Hathaway shareholder forum in May 2018 despite the new GAAP accounting rule that has led to a $1.14 billion net loss for the Buffett-Munger stock portfolio. Berkshire reports a $1.14 billion loss in 2018Q1 or its first net loss since 2009 due to an esoteric GAAP accounting rule that Buffett considers a nightmare. The firm also reports an operating profit of 48.7% year-over-year. The new GAAP rule suggests that the change in investment gains and losses must be shown in all net income figures. This requirement produces some wild and capricious gyrations in the GAAP bottom-line.

Berkshire owns $170 billion tradable stocks, and the market values of these stock positions can easily fluctuate by $10 billion or more within each quarter. Including gyrations of such magnitude in net income swamps the more important numbers that better describe Berkshire Hathaway's true operating performance. Buffett thus pierces the key GAAP veil for Berkshire investors to better assess the fundamental intrinsic value of each stock position. Buffett continues his active interest in small-to-mid-cap profitable value stocks that inject capital conservatively in both capital equipment and balance sheet expansion.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-07-29 11:33:00 Monday ET

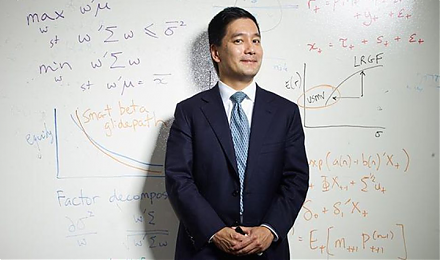

Blackrock asset research director Andrew Ang shares his economic insights into fundamental factors for global asset management. As Ang indicates in an inter

2025-09-21 12:32:00 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2020-10-27 07:43:00 Tuesday ET

Most agile lean enterprises often choose to cut costs strategically to make their respective business models fit for growth. Vinay Couto, John Plansky,

2020-06-17 09:23:00 Wednesday ET

Successful founders focus on their continuous growth, passion, perseverance, and the collective wisdom of most team members. William Ferguson (2013) &

2018-10-15 09:33:00 Monday ET

Several pharmaceutical companies now switch their primary focus from generic prescription drugs to medical specialties such as cardiovascular medications an

2025-10-04 13:37:00 Saturday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund