2018-03-01 07:35:00 Thu ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Trump imposes high tariffs on steel (25%) and aluminum (10%) in a new trade war with subsequent exemptions for Canada and Mexico. The Trump administration's Trade Act Section 232 investigation suggests that the main sources of U.S. steel-and-aluminum trade deficits are Canada, Europe, Mexico, and China.

In light of both Section 301 and Section 232 investigations, the steel and aluminum tariffs seem to target China and the European Union. There are a pair of pertinent problems with imposing tariffs on foreign imports of this nature. First, the tariff tactic is a massive diplomatic gambit. In effect, this tactic may pose the imminent risk of retaliation from multiple countries. Second, this strategic move can inevitably lead to higher consumer prices from food cans to cars and airplanes insofar as these products involve the use of steel or aluminum. These price increases can thus feed back to fuel higher inflation in America. Also, American households and firms may experience higher costs and so lower disposable income. The resultant decrease in aggregate demand can be detrimental to U.S. economic output, employment, capital investment, and so on. When push comes to shove, the law of inadvertent consequences counsels caution.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-09-01 10:31:00 Sunday ET

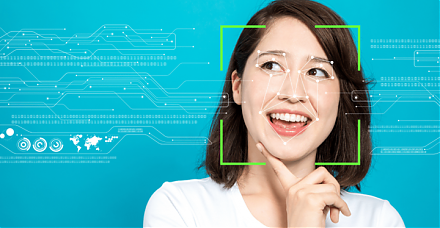

Most artificial intelligence applications cannot figure out the intricate nuances of natural language and facial recognition. These intricate nuances repres

2018-11-15 12:35:00 Thursday ET

Warren Buffett approves Berkshire Hathaway to implement new meaningful stock repurchases. Buffett sends a positive signal to the stock market with the Berks

2023-10-28 12:29:00 Saturday ET

Paul Morland suggests that demographic changes lead to modern economic growth in the current world. Paul Morland (2019) The human tide: how

2019-11-07 14:36:00 Thursday ET

America expects to impose punitive tariffs on $7.5 billion European exports due to the recent WTO rule violation of illegal plane subsidies. World Trade Org

2025-10-31 12:26:00 Friday ET

With respect to wider weight loss treatment and obesity treatment, the global market for GLP-1 medications now grows substantially to benefit more than 1 bi

2019-05-23 10:33:00 Thursday ET

Berkeley professor and economist Barry Eichengreen reconciles the nominal and real interest rates to argue in favor of greater fiscal deficits. French econo