2017-02-25 06:44:00 Sat ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

As the White House economic director, Gary Cohn suggests that the Trump administration will tackle tax cuts after the administration *repeals and replaces* Obamacare.

The dynamic scoring modus operandi helps economic advisors assess both costs and benefits to ensure tax-revenue neutrality over a 10-year period.

A border adjustment tax on most imports from China, Mexico, Japan, and other countries will be a major source of public finance for this fiscal tax optimization.

Subsequent greenback appreciation can then neutralize the inflationary effect of this border tax.

The current interest rate hike will contribute to this dollar appreciation for better current-account neutrality.

Mainstream media has speculated that Gary Cohn might be a good candidate under consideration for the top post of the Federal Reserve after Janet Yellen steps down as Fed Chair in February 2018. However, President Trump should probably keep Cohn in his current role as White House chief economist to lead the fiscal tax overhaul program through congressional confirmation and scrutiny.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-06-14 10:26:00 Wednesday ET

Daron Acemoglu and James Robinson show that good inclusive institutions contribute to better long-run economic growth. Daron Acemoglu and James Robinson

2018-07-17 08:35:00 Tuesday ET

Henry Paulson and Timothy Geithner (former Treasury heads) and Ben Bernanke (former Fed chairman) warn that people seem to have forgotten the lessons of the

2020-02-12 09:31:00 Wednesday ET

Mark Zuckerberg develops Facebook as a social network platform to help empower global connections among family and friends. David Kirkpatrick (2011) T

2025-10-31 12:26:00 Friday ET

With respect to wider weight loss treatment and obesity treatment, the global market for GLP-1 medications now grows substantially to benefit more than 1 bi

2024-04-02 04:45:41 Tuesday ET

Stock Synopsis: High-speed 5G broadband and mobile cloud telecommunication In the U.S. telecom industry for high-speed Internet connections and mobile cl

2019-04-17 11:34:00 Wednesday ET

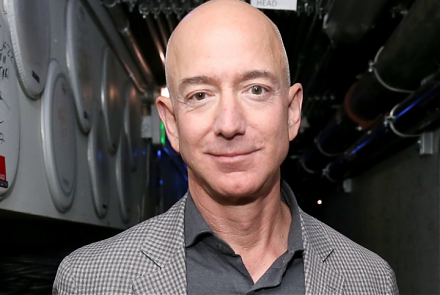

Amazon CEO Jeff Bezos admits the fact that antitrust scrutiny remains a primary imminent threat to his e-commerce business empire. In his annual letter to A