2017-08-31 09:36:00 Thu ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

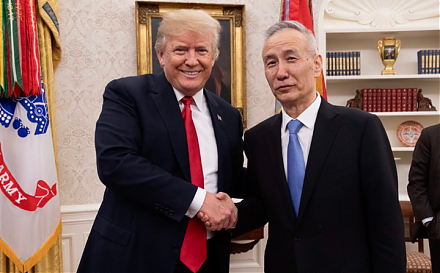

The Trump administration has initiated a new investigation into China's abuse of American intellectual property under Section 301 of the Trade Act of 1974. This strategic move boils down to the fact that the U.S. has just fired the first shot in an open trade war with China. While tax cuts trump trade, this Section 301 investigation can be the first tangible economic sanction against China.

However, Chinese retaliation may manifest in the generic form of large-scale U.S. Treasury bond sales, much less usage and consumption of U.S. soybeans, oats, semiconductors, mobile electronic devices, and other key imports, or both. These economic repercussions reverberate up and down the corporate value chain to induce an adverse impact on U.S. manufacturers, upstream suppliers, and downstream distributors nationwide.

Despite this clear and present trade war with China, the Trump stock market rally continues to benefit the typical institutional or retail stock investor under Section 301 legal protection of U.S. intellectual property. The main beneficiaries are the R&D-intensive firms with numerous patents such as pharmaceutical companies such as Pfizer, Merck, and Johnson & Johnson, tech-savvy platform orchestrators such as Apple, Google, Microsoft, Facebook, and IBM, as well as ecommerce giants such as Amazon and Alibaba.

A potential threat may be the new opportunity. Every cloud has a silver lining!!

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-02-02 11:32:00 Sunday ET

Our fintech finbuzz analytic report shines fresh light on the current global economic outlook. As of Winter-Spring 2020, the analytical report delves into t

2018-06-11 07:44:00 Monday ET

Facebook, Apple, Amazon, Netflix, and Google (FAANG) have been the motor of the S&P 500 stock market index. Several economic media commentators contend

2023-07-21 10:30:00 Friday ET

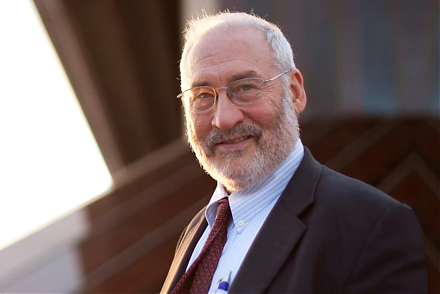

Joseph Stiglitz and Andrew Charlton suggest that free trade helps promote better economic development worldwide. Joseph Stiglitz and Andrew Charlton (200

2026-02-14 11:26:00 Saturday ET

Our AYA fun podcasts deep-dive into the current global trends, topics, and issues in macro finance, political economy, public policy, strategic management,

2018-10-17 12:33:00 Wednesday ET

The Trump administration blames China for egregious currency misalignment, but this criticism cannot confirm *currency manipulation* on the part of the Chin

2025-09-13 12:23:00 Saturday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund