2019-08-20 07:33:00 Tue ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

The recent British pound depreciation is a big Brexit barometer. Britain appoints former London mayor and Foreign Secretary Boris Johnson as the prime minister. The Conservative Party selects Johnson as the successor to Theresa May to set the stage for fresh Brexit negotiations with the European Commission. This change hits the pound with volatile exchange rate gyrations. The British pound sinks to the new lowest level of US$1.24 in 2017-2019. Johnson advocates that he would be keen to force Brexit with or without a post-May deal on October 31, 2019, which is the latest deadline for Britain to depart the European Union. Alternatively, Britons might consider a second referendum on Brexit with the backstop agreement for free flows of goods between Northern Ireland and the Irish Republic.

Most stock market analysts predict that leaving the European Union with no proper deal would plunge the U.K. into a deep economic recession due to Eurozone trade constraints and capital outflows. U.K. stock markets would fall 5% in light of a 2% decrease in economic output, and the pound would likely plummet 10%-13%. This prediction accords with what the U.K. Office for Budget Responsibility suggests in its recent report on the British economic outlook.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-08-07 07:33:00 Tuesday ET

President Trump sounds smart when he comes up with a fresh plan to retire $15 trillion national debt. This plan entails taxing American consumers and produc

2020-10-06 09:31:00 Tuesday ET

Strategic managers envision lofty purposes to enjoy incremental consistent progress over time. Allison Rimm (2015) The joy of strategy: a bu

2023-12-10 09:23:00 Sunday ET

U.S. federalism and domestic institutional arrangements A given country is federal when both of its national and sub-national governments exercise separa

2019-02-11 09:37:00 Monday ET

Corporate America uses Trump tax cuts and offshore cash stockpiles primarily to fund share repurchases for better stock market valuation. Share repurchases

2019-10-29 13:36:00 Tuesday ET

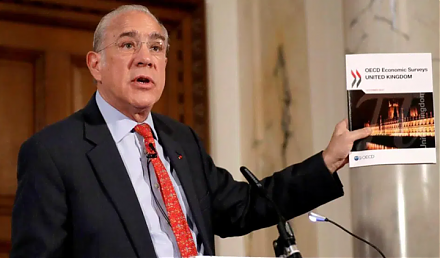

The OECD projects global growth to decline from 3.2% to 2.9% in the current fiscal year 2019-2020. This global economic growth projection represents the slo

2019-06-11 12:33:00 Tuesday ET

Dallas Federal Reserve Bank President Robert Kaplan expects the U.S. economy to grow at 2.2%-2.5% in 2019-2020 as inflation rises a bit. In an interview wit