2018-02-19 08:39:00 Mon ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

The root cause of this rare incidence may be Snap's recent redesign, or Jenner's newfound motherhood. The former can be a real concern that her 25 million Twitter followers share in numerous replies. These empathetic users aggravate this deep concern about Snap's recent redesign and thereby echoes ambivalent Wall Street investor sentiments.

Several Wall Street stock analysts point out that it can be more difficult for Snap to monetize the Snapchat business model in contrast to ad-income-driven Facebook, Google, and Twitter. In recent times, Snap initiates some smart strategic moves to draw a clear line between social interactions and media posts and video streams. In fact, Snap needs to manage this interim transition well as celebrity influencers such as Kylie Jenner are an essential source of high-quality content in the Snap recipe for success. With 25 million Twitter followers, Jenner carries a great deal of social influence over millennials.

In terms of demographic attributes, the typical Snapchat user is between 18 and 24 years old and tends to have much shorter attention span.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-02-03 08:27:00 Friday ET

Our proprietary alpha investment model outperforms most stock market indices from 2017 to 2023. Our proprietary alpha investment model outperforms the ma

2019-09-30 07:33:00 Monday ET

AYA Analytica finbuzz podcast channel on YouTube September 2019 In this podcast, we discuss several topical issues as of September 2019: (1) Former

2018-05-29 11:40:00 Tuesday ET

America and China, the modern world's most powerful nations may stumble into a **Thucydides trap** that Harvard professor and political scientist Graham

2023-02-07 08:26:00 Tuesday ET

Michel De Vroey delves into the global history of macroeconomic theories from real business cycles to persistent monetary effects. Michel De Vroey (2016)

2018-01-05 07:37:00 Friday ET

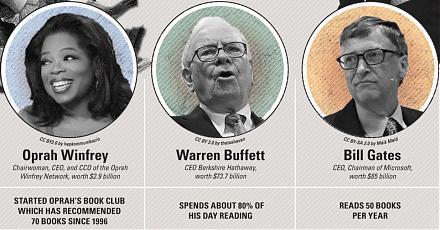

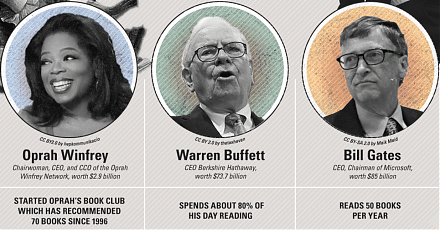

Warren Buffett cleverly points out that American children will not only be better off than their parents, but the former will also enjoy higher living stand

2026-04-30 08:28:00 Thursday ET

In the current global market for better biotech advances, medical innovations, and healthcare services, the new integration of artificial intelligence (AI)