2019-05-05 10:34:00 Sun ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Former Vice President Joe Biden enters the next U.S. presidential race with many moderate-to-progressive policy proposals. At the age of 76, Biden stands out the presidential race as the favorite among Democratic voters in the recent polls. Biden enters the fray with a half-century of government experience with senior roles as the former chairman of Senate Foreign Relations Committee and vice president under President Barack Obama. On public finance, Biden cites high health care and energy costs as the primary threats to the economic prosperity of U.S. firms. Addressing these economic issues helps U.S. firms better compete worldwide. In addition, Biden supports better balancing the fiscal budget with deficit reductions. This fiscal policy stance contrasts with big tax cuts under the Trump administration. Biden indicates the essential need for U.S. banks to operate under the 5 key pillars of financial regulation: capital rules, low-leverage limitations, liquidity requirements, macroprudential stress tests, and deposit insurance constraints.

On agriculture, Biden opposes importing non-native species, which inadvertently alter domestic vegetation, compete with native species, introduce new diseases, and interfere with maritime commerce. Biden also supports a $15 minimum wage proposal, higher taxation on capital investment income, no tuition for public college students, and broader infrastructure.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2025-06-28 10:39:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why great mental focus serves as a vital mainstream driver of personal

2020-05-21 11:30:00 Thursday ET

Most blue-ocean strategists shift fundamental focus from current competitors to alternative non-customers with new market space. W. Chan Kim and Renee Ma

2019-10-19 16:35:00 Saturday ET

European economic integration seems to have gone backwards primarily due to the recent Brexit movement. Brexit, key European sovereign debt, and French and

2019-08-31 14:39:00 Saturday ET

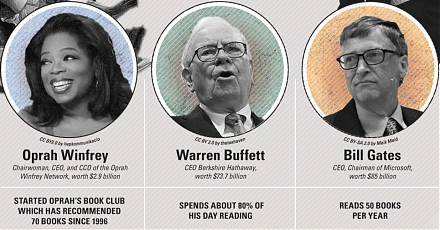

AYA Analytica finbuzz podcast channel on YouTube August 2019 In this podcast, we discuss several topical issues as of August 2019: (1) Warren B

2017-02-25 06:44:00 Saturday ET

As the White House economic director, Gary Cohn suggests that the Trump administration will tackle tax cuts after the administration *repeals and replaces*

2019-08-22 11:35:00 Thursday ET

Fundamental factors often reflect macroeconomic innovations and so help inform better stock investment decisions. Nobel Laureate Eugene Fama and his long-ti