2017-06-27 05:40:00 Tue ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

These famous quotes of self-made billionaires are inspirational words of wisdom on financial management, innovation, and entrepreneurship.

For financial investment decisions, we should be fearful when others are greedy, and we should be greedy when others are fearful.

For entrepreneurial ambitions, we need not focus on money all the time; instead, we should focus on making an impact in our open global society.

For innovative breakthroughs, our frugality can be a major plus because frugal innovation is often the key to success in today's business world.

For environmental responsibilities, it is relatively simple to make money today, but it is difficult for one to make sustainable money while he or she remains responsible to the society in improving the global environment.

In any case, we should strive to *learn* fresh insights and ideas just as students try to accomplish bigger and better achievements with a positive attitude toward continual improvements in small but significant increments over time.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-11-05 09:45:00 Sunday ET

President Trump criticizes the potential media merger between AT&T and Time Warner, the latter of which owns the anti-Trump media network CNN. President

2024-01-31 14:33:00 Wednesday ET

The new world order of trade helps accomplish non-economic policy goals such as national security and technological dominance. To the extent that freer

2018-12-03 10:40:00 Monday ET

Bank of England publishes its latest insights into the economic impact of Brexit on British real productivity, capital investment, and labor supply as of 20

2019-05-05 10:34:00 Sunday ET

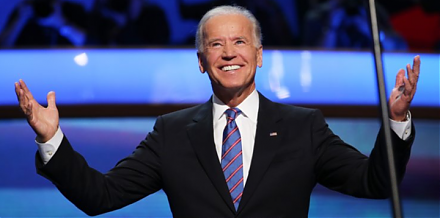

Former Vice President Joe Biden enters the next U.S. presidential race with many moderate-to-progressive policy proposals. At the age of 76, Biden stands ou

2019-09-07 17:37:00 Saturday ET

Federal Reserve Chair Jerome Powell announces the monetary policy decision to lower the federal funds rate by a quarter point to 2%-2.25%. This interest rat

2019-08-10 21:44:00 Saturday ET

McKinsey Global Institute analyzes 315 U.S. cities and 3,000 counties in terms of how tech automation affects their workers in the next 5 to 10 years. This